Let's Make Financial Modeling For Startups Fun Again

Read Time: 3 min

Learn how to build a financial model, do financial forecasts, and what financial resources are needed to start a business.

Steal my simple financial modelling software in Excel for startups.

I opened my first company in Germany.

It's as good as any other country to run a company in, right?

Germany is arguably one of the heaviest-regulated business environments in the world.

Running a company there for years left me traumatized and, at times, made finances a nightmare for us.

I was playing the game in hard mode.

I learned that finances can ruin your party before it even starts.

Blue-eyed as we were, we outsourced our bookkeeping, controlling and tax accounting.

They were a reputable accounting firm in a major city in Germany—decades of experience.

They will handle things for us, right?

We communicated our reporting needs frequently and clearly.

They promised us that this would be no problem.

They're the experts. They do this daily with bigger, more complicated firms than ours, right?

So we let them push the start date of the monthly reporting month by month further back as they needed more time.

Then, one year after we onboarded them, we finally got a monthly financial report.

The financial reports were missing the most basic numbers relevant to our survival. 🤦🏼♂️

This is when I took matters into my own hands.

I opened Google Sheets and created my own internal bookkeeping and reporting.

I filled it in by hand every month. This process took me 1-2 hours every week.

Finally, we regained control over our business.

This dashboard included expenses, cash reserves, and outstanding liabilities.

At that point, the runway didn't look good anymore.

We would have made very different decisions if we had these numbers six months earlier.

Having a financial model would have saved us 150k EUR in yearly expenses.

I'm not even calculating the tax savings we could have had, which are 10x that money.

Start Your Financial Modeling Game

I know finances are the boring part of doing business or might even induce anxieties.

It doesn't have to be that way.

Set it up once. Then, you can play with it and create your very own crystal ball to see the future.

I mean, literally, play with it.

If your company has a sound financial model, it is a sandbox where you can play and experiment.

Make assumptions on how a change in your market, product, or new hire might affect your finances.

Then, see how it plays out on your runway.

Spot problems long before they arise and navigate the ship cool around it.

Find simple opportunities to accelerate your growth without more hustle.

Having a sound financial model gave me a lot of peace of mind and better sleep.

A sound financial model early on for that company in Germany could have saved us roughly 1.5m EUR.

Just recently, I was helping someone build their new business.

They had anxiety attacks just thinking about finances.

Sitting down and crunching numbers for their business made them run away.

Within one session, I introduced them to financial modelling.

I showed them:

How to play with their model.

The few key numbers they needed to keep an eye on.

And how to let someone else do the tracking for them.

Their anxieties were gone.

They were pondering whether they should take a loan to kickstart the business.

After the session, they had a clear answer within five minutes of playing with their new financial model.

No loan was necessary.

Less liabilities, less risk, and less stress for them.

How To Start Financial Reporting

OK, where should you start when you do not know your finances?

A dashboard with two numbers and a single line graph tracked monthly is enough to get started.

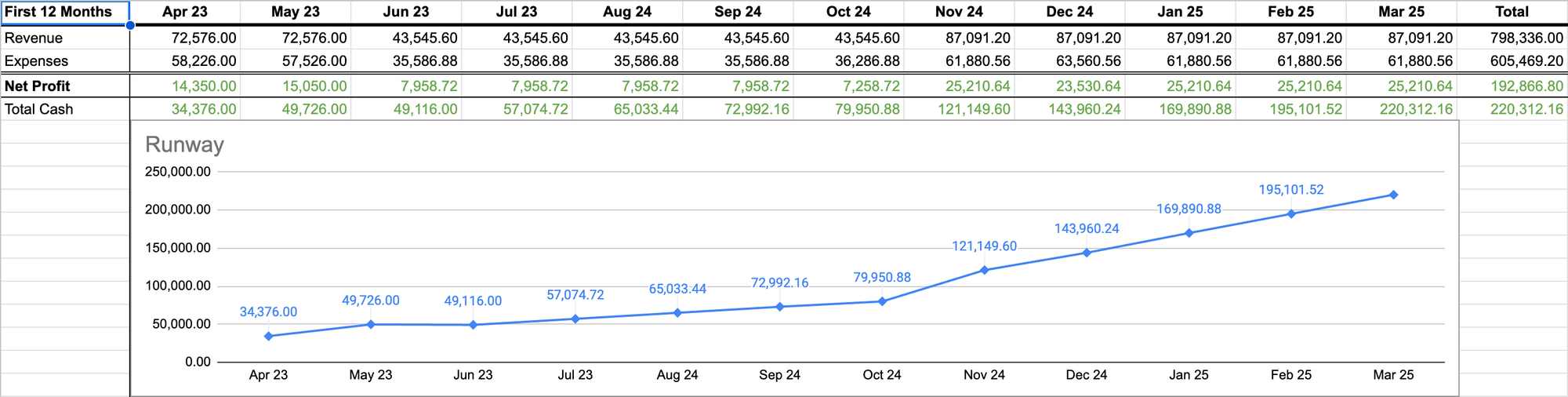

You should know your net profit every month.

This is all your revenue minus all your expenses.

Net Profit = Revenue - Expenses

You should also know how much cash is still left in your bank accounts at the end of the month—your total cash.

Create a line graph with these numbers.

Project your total cash for the next 12 months and adjust it by the expected monthly net profit.

This line graph is your runway. Your company’s health bar. If this line dips below zero, you lose the game.

Now, play with your projection.

Develop assumptions of how net profit changes in the coming months according to your actions.

Every month, you replace your assumptions with the actual numbers you saw this month.

How much were your assumptions off? And why?

Find a way to keep the net profit in the green and your health bar above zero!

I linked a simplified financial model for startups below for you to get started with.

>>> Steal my simple financial model for startups.

If you have investors, they might want to see more numbers.

You can find these numbers also in that simple financial model.

Play With Your Numbers

You can dive as deep as you want into the different areas of your business and model them in detail.

Come up with your own profit formula and figure out which levers move your net profit needle most.

Run fun experiments pulling one lever at a time, and see how you get closer to your goals.

This will make your predictions more accurate and your assumption game more interesting.

However, only net profit, total cash, and your runway health bar are necessary to keep the party going.

Would you like to hear more about financial modelling?

Tell me in the comments below!

WANT TO LEVEL UP YOUR BUSINESS GAME?

Read all articles one week early.

Thanks for reading to the end!

You rock!

Cheers,

Marcel